Residential Property Management

Optimizing real estate investments through collaboration and mutual trust.

Make the Right Move

With over 30 years of experience, we have a proven reputation of trust with our clients. Dan Schlichte and Eric Crouser, our managing partners each bring valuable expertise to the table. Dan has extensive knowledge of residential real estate, and Eric has a strong finance background. Combine these two skill sets, and you get the right combination that enables us to manage your investment property wisely, with the goal of increasing its value, and alleviating you of the burden of managing your own property. When a property is placed under our management, we treat it as if it was our own.

Communication

Our commitment to accessibility and transparency ensures you get the information you need when you want it.

Tenant Relations

We serve as the direct point of contact for your tenant, whether it be routine or an after-hours emergency call.

Property Maintenance and Preservation

We strive to not only maintain your property, but identify ways to lower maintenance expenses and enhance value.

Financial Management

We deliver the financial information you need to make informed decisions regarding your property.

Leverage the Experience of a Local Property Manager

Managing a property alone can be frustrating, especially when you are located in a different town or state. When involving the help of professionals, the process is simplified and less stressful. Our property managers at Performance Property Management take a proactive approach to managing the tenant relationship. This often results in a longer tenancy, less turnover cost, and a more pleasant experience for the Landlord.

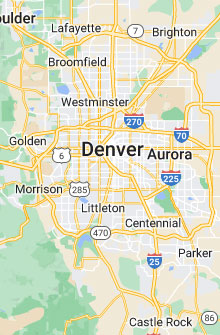

Serving: Aurora, Denver, Golden, Lakewood, Littleton, Highlands Ranch, Lone Tree, Castle Rock, Parker, Centennial, Englewood, Arvada, Brighton, Wheat Ridge, Lafayette, Louisville, Boulder, Erie, Thornton, Northglenn, Commerce City, Castle Pines

Our Vision and Values

We strive to become leading members of our community not only in a professional capacity, but also by building relationships and serving our neighbors.

We both believe in mutual trust, reliability, integrity, hard work, and being able to be accessed by our clients easily. In our company, we are the ones that pick up the phone when you call. Most of all, we value personal relationships.